How changes in value affect buyers, sellers, homeowners and investors

Transcript

“Hello and welcome back to daily buying tips, I’m Dean Berman from Berman Buys.

Today we’re going to talk about how changes in value affect buyers, sellers, homeowners and investors.

We’ll on the surface this may seem relatively straight forward.

For buyers decreasing values are good as property becomes more affordable.

Increasing values are good for sellers, homeowners and investors as prices rise.

I think there’s more to it than that.

If you buy a property for a lower price than it was before.

Does this mean you had to sell for a lower price as well?

Not if your a first home buyer!

But besides first home buyers, doesn’t it just become relative.

i.e. if you sell in a rising market, you will most likely buy in a rising market i.e. it counterbalances itself.

i.e. make money on the sale, but lose money on the buy.

Where are homeowners and investors in all this?

If they don’t plan on selling anytime soon, then it doesn’t have a massive bearing.

Except if they are planning on purchasing more property in the market or using the collateral in the there houses for something.

Then it has a bearing as they will have less equity or collateral in a falling market, but they will likely be buying something that has also fallen.

It’s relative!

But if they aren’t planning on doing anything, then it basically becomes paper differences.

I think a question we always ask is?

Is it a good time to buy or sell or hold.

Maybe instead.

What are we planning to do?

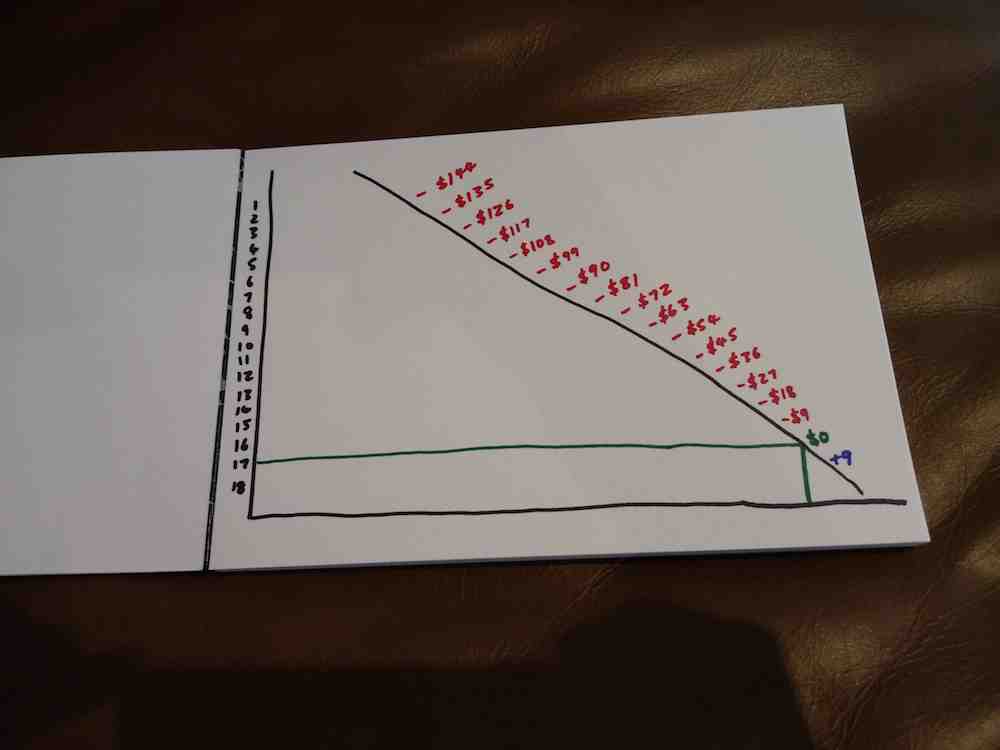

i.e. if your holding onto the property for 10+ years, is very different to someone looking to renovate for profit in 6 months.

Maybe we need to work out our goals before we look at the market.”