How long a property takes to go from being negatively geared to positively geared

Transcript

“Hello and welcome back to daily buying tips, I’m Dean Berman from Berman Buys.

Today we’re going to talk about how long a property takes to go from being negatively geared to positively geared.

Firstly, most properties are negatively geared when they start out.

This means you spend more on the property than you receive in income.

The opposite is positively geared.

Meaning the property effectively pays you to hold it i.e. the income generated is greater than the cost to hold the property.

Historically, as time goes by, rents usually increase.

Based on estimated SQM Research figures.

In Sydney this has been approximately 25% over the last 10 years.

31% for Melbourne.

13% for Brisbane.

On a $500,000 Sydney property this would be about $9 per week, per year.

Another thing you will often hear, is your property yields 4%.

Only to think to yourself, I have no idea what that means!

Well, I’m here to try and explain what a yield is.

It’s a term used to describe the percentage return you will receive based on your purchase price.

For example, a 4% yield on $500,000 purchase price means $20,000 return per year.

Or a rental of $384 per week.

Let’s assume the interest rate for your mortgage you have is at 4.5%.

Which means you are paying $22,500 per year in interest repayments to the bank.

This means you are $2,500 out of pocket or $48 per week.

There is also council rates, fixed water rates, property managers fees, maintenance, potential strata rates and other miscellaneous costs.

For simplicity, let’s assume these all come to $5,000 per year.

This means you currently earn $20,000 per year with no vacancy.

You currently spend $27,500 per year on expenses.

Therefore you currently are $7,500 per year out of pocket or $144 per week.

What happens over time is rents usually increase.

Let’s assume at a rate of 2.5% per year or $9 per week, per year for simplicity and to help in your understanding.

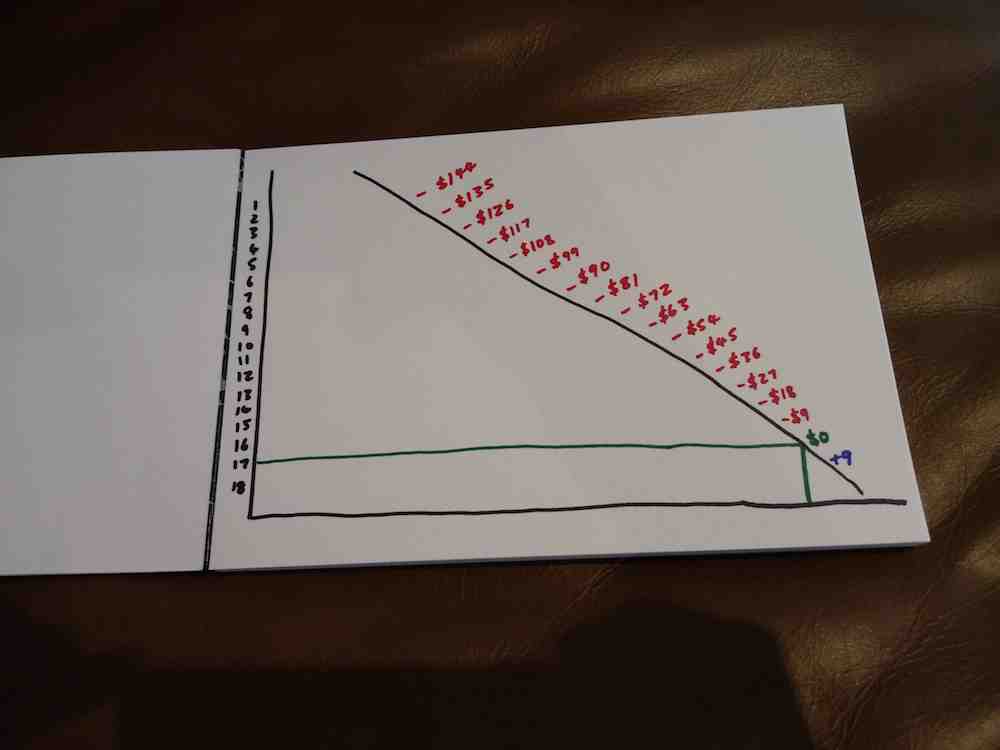

In year 2 this $144 would go down to $135.

Year 3 $126.

And so on until it becomes positive in year 18.

This basically drawn diagram shows, shows how a property becomes cash flow positive or positively geared in year 18, meaning the property is effectively holding itself in this example.

There are variables like interest rates which fluctuate both up and down which can affect the cash flow.

So too can rents.

In some years they won’t increase as quickly as these figures and depending on the location of the property there can be times of vacancy.

But this example has more been provided to help you understand how over time your investment property can become positively geared.”